Table of Content

Drivers may be uninsured or underinsured for the damage they cause. In these situations, it’s best to have uninsured motorist coverage. However, policy terms may differ. Continue reading to learn about the exclusions, limits, and essential details of this type of coverage.

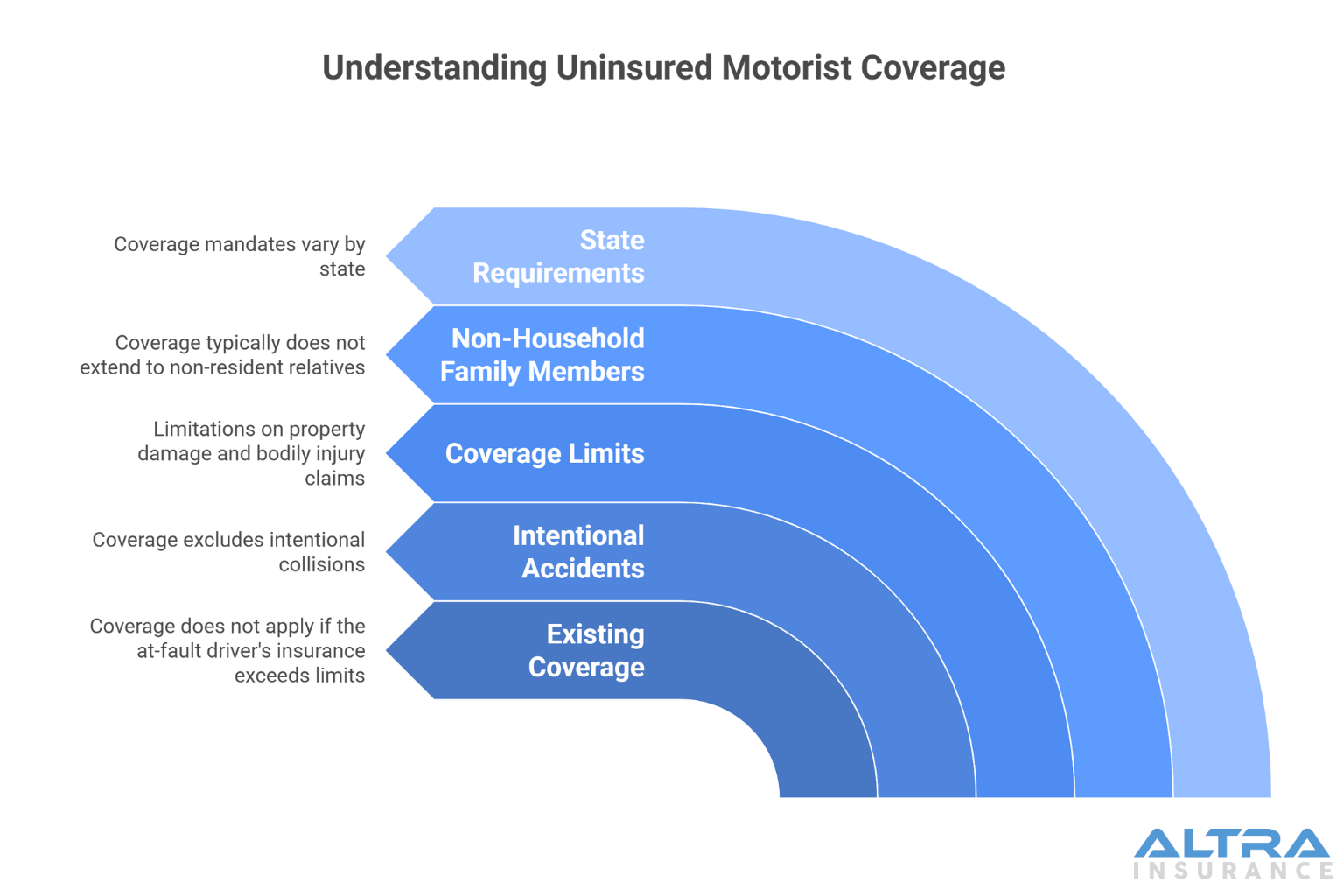

Existing Coverage and Intentional Accidents

If the driver at fault has auto insurance Chula Vista and it exceeds your uninsured motorist coverage limits, your policy won’t apply. However, the driver’s coverage will cover your damage, whether bodily or property, and should be covered.

Intentional collisions aren’t covered under the uninsured motorist policy, even when you’re not at fault. The coverage expands to accidental situations, not when a driver purposefully gets behind the wheel intending to cause a collision, injury, or death. Without an acceptable policy, the costs associated with repairs will generally fall upon you.

Coverage Limits

If you select uninsured motorist coverage, not all damage is covered. For instance, some states don’t cover all property damage, and others have limitations regarding these types of claims. The minimums per person and accident for bodily injury or death will vary due to limits.

Without limitations, it’s nearly impossible for insurance providers to manage financial risks. One catastrophic accident with high-value claims has the potential to financially bankrupt an insurer. Therefore, payout limits exist to meet the needs of policyholders while allowing a company to operate effectively. These stipulations often make insurance rates more affordable, allowing other drivers to protect themselves and other passengers.

Non-Household Family Members

Family members in your household are usually covered if they drive your car and have an accident with an uninsured driver, whether you’re there or not, but they must be listed on your policy and live at the same address.

A non-household family member won’t be covered by your policy. Individuals who are passengers at the time of an accident are generally covered. However, suppose an individual operates your vehicle and is involved in an accident with an uninsured motorist. In that case, your coverage typically won’t apply because the person driving your car isn’t what most providers refer to as a “resident relative.” You should understand your uninsured motorist policy’s coverage if an authorized person drives your car, whether you permitted it or not.

State Requirements

California law mandates this coverage, enabling clients to choose what suits them. However, not all states are required to offer it. In such cases, providers usually have other regulations and methods in place to address the damage caused by uninsured drivers, or they require drivers to have liability insurance.

In addition to this coverage, states can have other regulations in place, such as allowing providers to charge deductibles. Those requirements will also vary from state to state. It’s best to speak with an insurance representative to learn more about your state regulations, ensuring you have the appropriate coverage in the event of an accident.

If you want to know if you’re covered in the event of an accident with an uninsured driver, consult your insurance provider. Drivers who are searching for reliable, affordable auto insurance should reach out to the experienced professionals at Altra Insurance Services. In addition to auto coverage, we offer a variety of insurance products, including homeowners, business, and motorcycle insurance. San Diego residents should call one of our friendly agents today for a free quote.