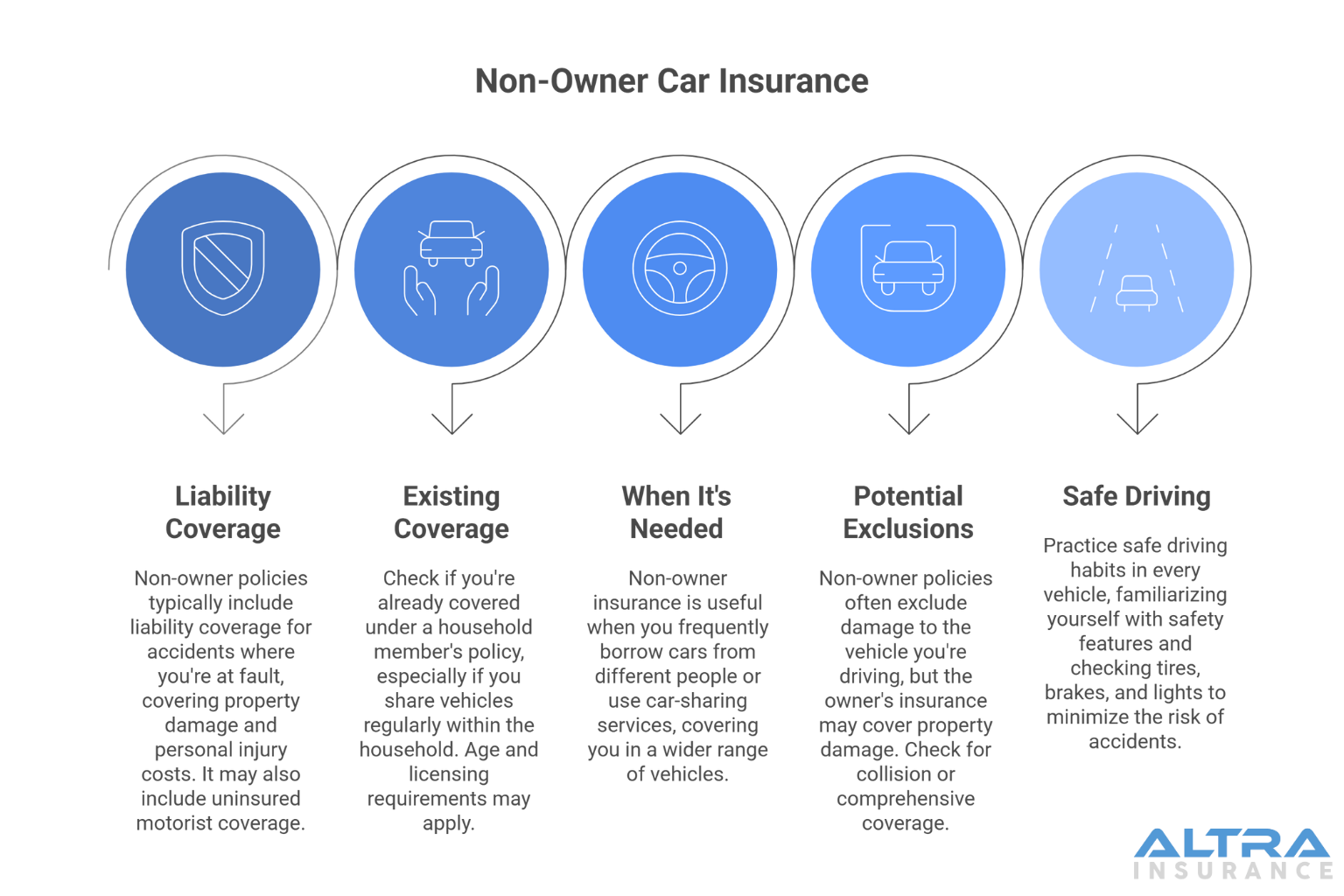

Maintaining financial responsibility in the event of a car accident is still important for many people who don’t have cars. Typically, this type of policy is called non-owner car insurance. Insurance companies offer these kinds of policies to help people who don’t own vehicles protect themselves from financial damages due to accidents when they drive other people’s cars. Knowing how non-owner car insurance works and when you may need it helps you purchase the right plan to fit your needs.

Understand How Liability Coverage Works

Non-owner policies typically only include liability coverage for accidents. If you’re determined to be at fault for the accident, this type of policy will cover property damage and personal injury costs for the other party. Having insurance coverage to handle potential claims helps you maintain more confidence that you won’t face costly lawsuits as a driver. Depending on your policy, it may also include uninsured motorist coverage for times when the other party is at fault and lacks the appropriate insurance coverage.

Find Out if You Already Have Coverage Under a Household Member’s Policy

Many car insurance policies cover drivers who live within the same household, since one can reasonably expect that family members and roommates may share a vehicle. Typically, you’ll need to meet specific age and licensing requirements for coverage under someone else’s policy. For instance, your teen driver may be covered under your policy as a parent. If you share cars regularly in your household and only drive those vehicles, it may make more sense to include certain people on the policy rather than purchasing a separate insurance plan.

Know When You Need Non-Owner Insurance

Many drivers have other circumstances in their lives that involve using different vehicles on a rotating basis. For instance, you may borrow multiple people’s cars who don’t live in your household. Or you may regularly use car-sharing services to get around town. Non-owner’s auto insurance covers you in a wider range of vehicles than just your household’s. Letting your insurance agent know about your driving habits can help him or her provide you with the best recommendation for purchasing a policy.

Understand Any Potential Exclusions

Many non-owner policies won’t cover damage to the vehicle you’re driving. But property damage might still be covered under the owner’s insurance policy. Checking to see if the owner has collision or comprehensive coverage can give you additional peace of mind when you get behind the wheel.

Follow Safe Driving Practices in Every Vehicle

Since you don’t own a vehicle, it’s important to continue to use extra caution when you’re driving someone else’s. Make sure to spend a few minutes getting familiar with the safety features on any new car you drive. Doing a quick check to make sure the tires and brakes are in good condition and the lights are working means you’ll be less likely to need to file a claim in the future.Your insurance agent can provide you with specifics on how you can get auto insurance without a car. If you’re looking for affordable, reliable car insurance and high-quality service, call on the trustworthy agents from Altra Insurance Services. We can also provide you with motorcycle, renters, and home insurance. San Diego residents should give us a call today.