The primary homeowners insurance payment options are annual and monthly. However, the payment timing can vary based on the type of coverage you have, the provider, your property, and more. It’s best to verify your payment requirements before accepting coverage, ensuring you make the most suitable and affordable selection. Continue reading to learn why some homeowners insurance must be paid yearly as well as other payment options.

Mortgage Lender Conditions

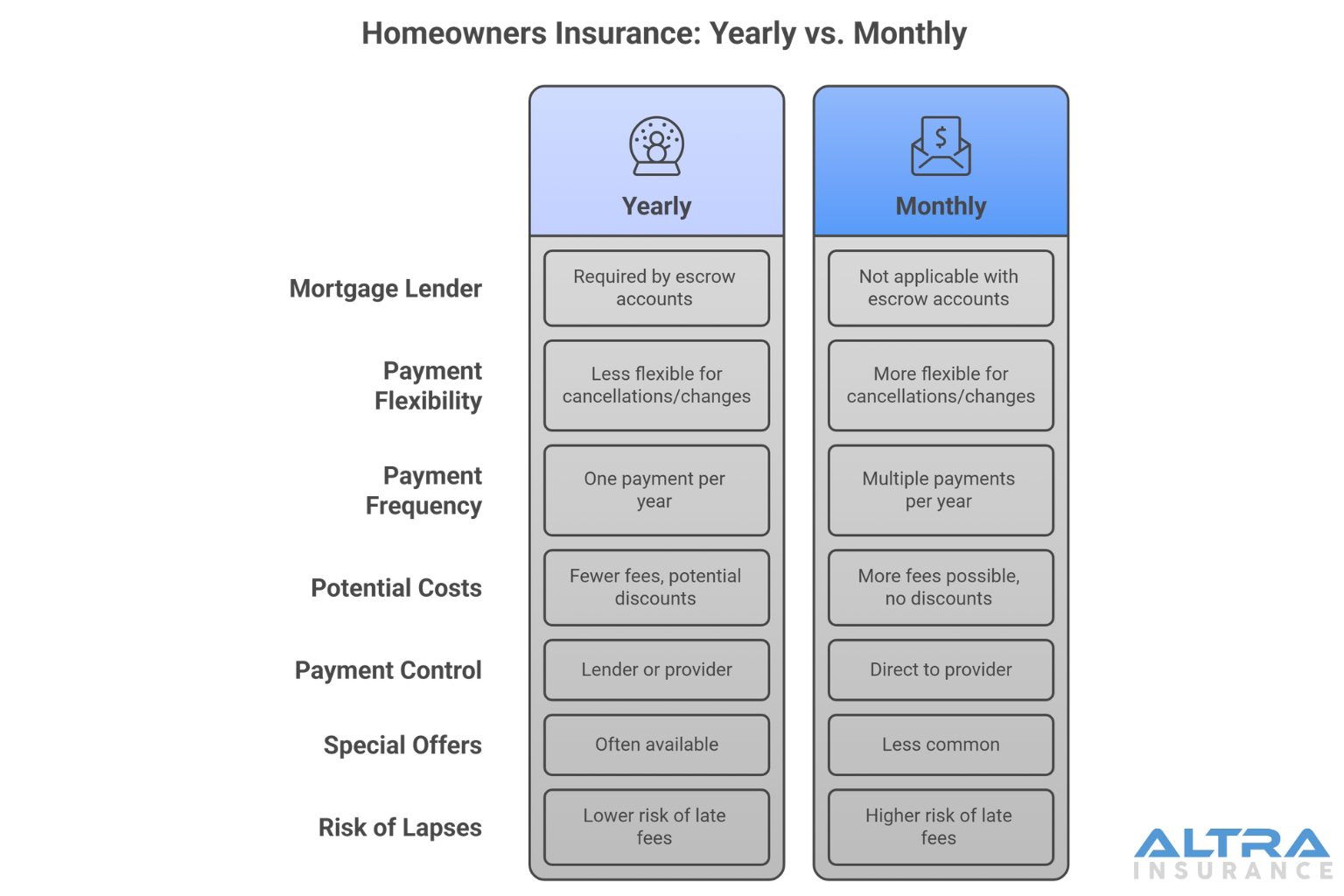

Escrow accounts generally require annual homeowners insurance payments. This is due to the savings account your lender manages, setting aside money to cover insurance, taxes, and other financial necessities. The objective is to protect the mortgage lender’s interest in the home. Remember, this is an investment, so guaranteeing the property is insured correctly can also protect your family in the long run.

With an escrow account, your annual payment can ensure the lender receives assistance in the event damage occurs to the home, if you fall behind on payments, or the insurance itself lapses for reasons beyond your control. Lenders estimate the annual insurance premium and often require a deposit into the escrow account, allowing the company to pay your insurance premium at its discretion.

Monthly Flexibility

Although yearly is an option, in some cases, paying monthly is permitted. Many homeowners prefer this billing cycle due to the budgeting flexibility it offers. Spreading the payments out each month can free up your monthly funding, making the adjustment to the expense more flexible.

You can also cancel or report changes with more ease with this option, whereas paying homeowners insurance up front yearly could make it more challenging when you want to request refunds or report unacceptable actions and services. As your preferences shift, you have more flexibility, regardless of your current financial situation.

Additional Factors

Although monthly and yearly are the most common payment choices, some providers offer weekly, quarterly, and semiannual payments. Keep in mind the fees associated with these options could lead to higher costs due to the additional payment frequencies. If you decide to bundle your payments with other coverage types, this could determine the payment schedule.

If you no longer pay your lender for various reasons, including the loan being paid in full, you won’t have to give the insurance premium payments directly to the lender. Instead, you can pay your provider, receiving the option to make direct payments that suit your finances best.

Advantages of Annual Insurance Payments

With yearly payments, you often receive special offers and lower premiums. Reducing the risk of late payment fees can also save you time and money. Insurers could apply discounts because of the increased cash flow, which can offset the costs of claims or other issues.

The fees often associated with monthly payments are also eliminated, making the annual cost lower. You also ensure your home remains insured year-round.

For information on choosing affordable homeowners insurance with payments that suit your needs, call on the experienced agents at Altra Insurance Services. In addition to homeowners coverage, we offer a variety of reliable insurance products, including business, renters, and car insurance Chula Vista. Call us today to learn more about our high-quality service and affordable coverage.