Many insurance agencies will search your credit score when determining the type of offers you’re eligible to receive and choosing a specific rate. However, the way you maintain your financial history plays a significant role, and this includes maintaining auto insurance.

Soft and Hard Inquiries

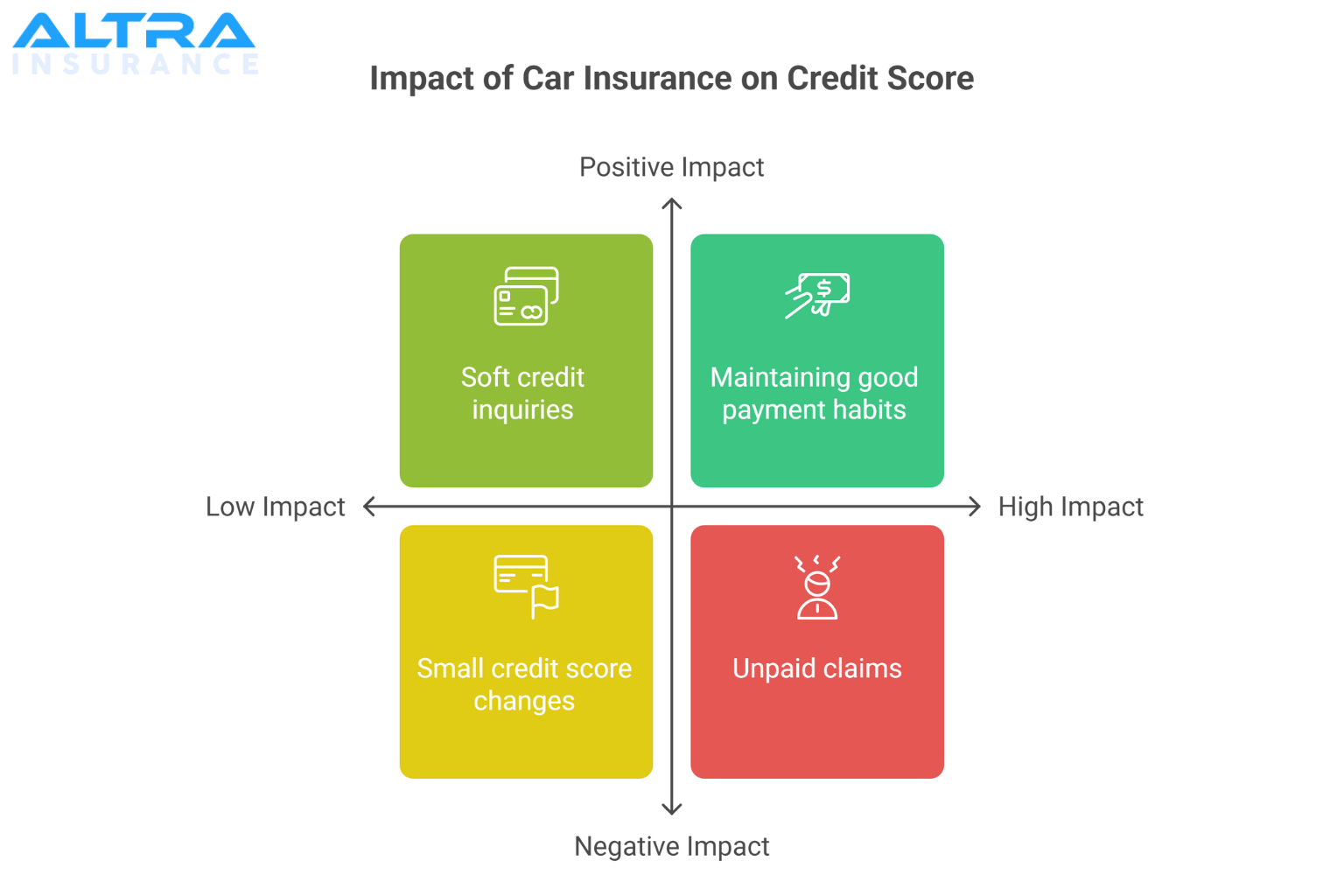

In some instances, an auto insurance request may impact your score, but the change is generally minimal, typically by less than five points. The main reason is that you’re perceived as taking on more debt, which labels you as a higher risk to other lenders. However, most companies, including smaller agencies or providers in California, don’t use credit scores at all. Instead, they use different underwriting methods.

Before accepting a car insurance policy, assess your needs accordingly and go over all the information you’ve gathered from research, including the provider’s reputation and policy details from other customers. These steps could lower the impact on your credit history.

Good Payment Habits

Maintaining a great payment history can help you avoid lowering your credit score. In some cases, auto insurance providers offer customers the option to pay an annual fee, which can result in a significant discount. Taking this step allows you to avoid missing payments, which lowers the risk of having an unpaid debt on your credit report and keeps your vehicle covered at all times.

You can also select auto-pay, which means the insurance provider will collect the agreed-upon amount automatically, reducing your risk of missing timely payments. As a result, these good habits can boost your credit score, leading to more favorable offers and lower insurance rates in the future.

Staying with the Same Provider

Selecting a new auto insurance policy can hurt your credit score, especially if the provider cancels your coverage. Other financiers may view you as a credit risk, which could cause them to deny coverage or offer a higher rate than most standard account holders.

Before agreeing to an insurance provider, ensure the coverage suits your needs best. The goal is to stay with the company and lower your odds of being canceled. However, if you have no other choice, verify the provider doesn’t list any unwarranted entries on your credit report. If so, follow the necessary steps to correct these mistakes and improve your financial history to receive lower auto insurance rates, housing loans, credit cards, and other premiums over time.

Additional Factors

Proper payment also includes avoiding unpaid claims, such as deductibles and medical expenses. Doing so could result in outstanding balances being sent to collection agencies. When the unpaid balance is reported to a credit bureau, it will lower your score.

Your driving record is just as essential to your credit report as your current auto insurance. Lenders and protectors will also verify the type of vehicle you own, learning more about your creditworthiness when it comes to being approved for an automobile or paying the investment off in full, as well as your current employment and the location in which you reside.

If you’re looking for affordable, reliable car insurance and high-quality service, call on the experienced agents at Altra Insurance Services. We can help you with a wide variety of insurance options, including motorcycle, homeowners, and renters insurance. San Diego residents should call one of our friendly representatives today.