Table of Content

Purchasing a home comes with many responsibilities, and insuring the property is one of them. However, there are different options available, which can often confuse individuals, especially regarding the distinction between mortgage insurance and homeowners insurance. While both are beneficial, one may not provide the coverage you’re seeking. Continue reading as the experts at Altra Insurance Services, a leading provider of home, renters, commercial, and car insurance San Diego residents can rely on, explain the differences between the two so you can make an informed decision that best suits your needs, budget, and home.

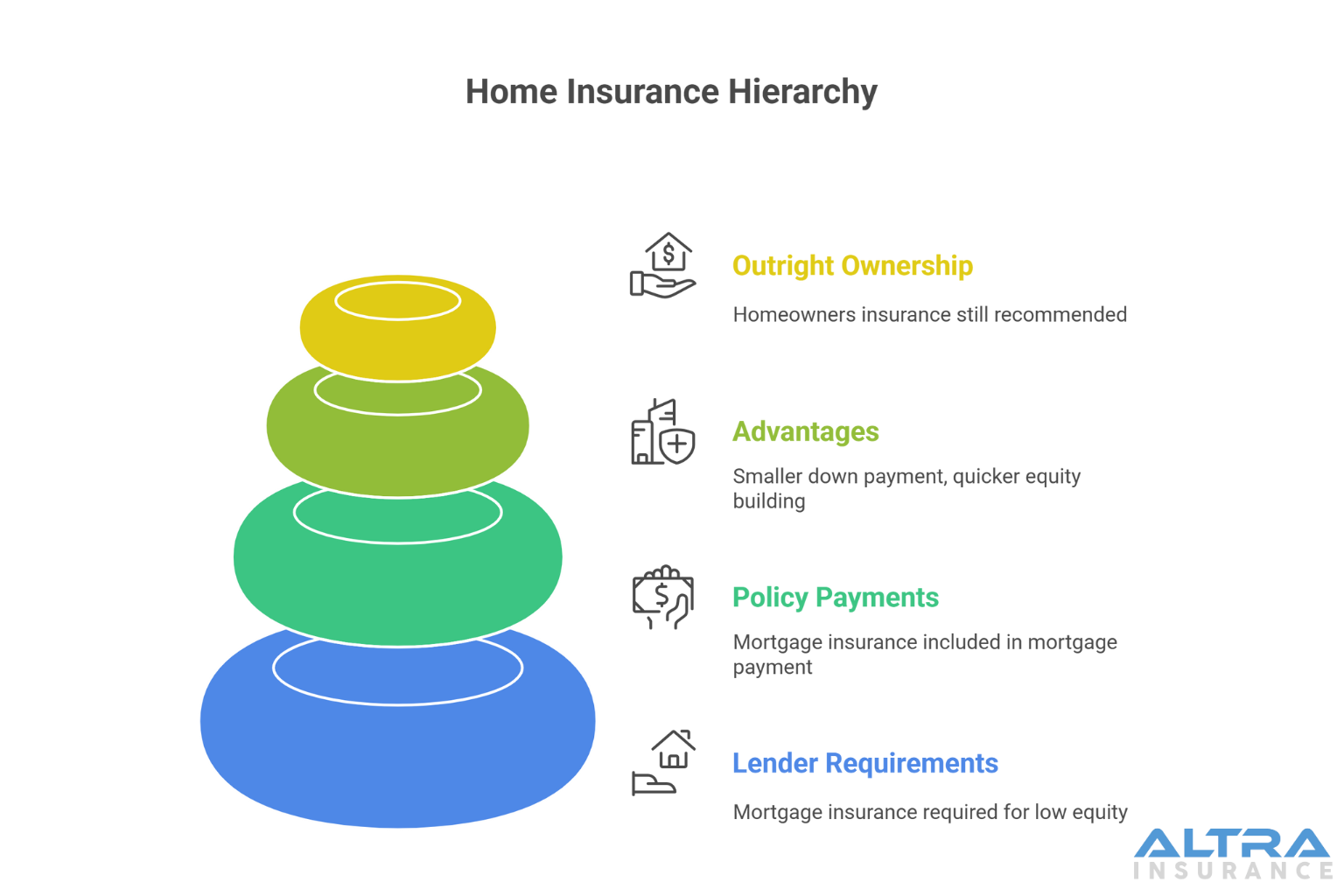

Lender Requirements

Mortgage insurance is typically required if you have less than twenty percent equity in your home. With this coverage, the lender is protected in the event you default on a loan. Therefore, in some situations, a provider may require you to have mortgage insurance as well as homeowners insurance.

Once you’ve reached the twenty percent equity via loan payments, your lender may cancel the mortgage insurance policy, allowing you to maintain homeowners insurance only. To be certain, always ask up front to avoid any financial or legal issues.

Policies and Mortgage Payments

One benefit of mortgage insurance is that most lenders include the payment amount in your monthly mortgage payment. This can protect the lender’s risks associated with lending for the home. Many lenders prefer and require it for borrowers with high loan-to-value ratios.

Although both types of insurance could be bundled into one single payment each month, your mortgage won’t cover the costs of homeowners insurance. Instead, separate funding will need to be provided, which is generally set up in an escrow account. Your mortgage lender will typically use this account to pay property taxes and homeowners insurance.

Advantages

Regardless of whether you need to purchase both types of coverage, the policies offer their benefits, making them worthwhile investments. For instance, with mortgage insurance, you can make a smaller down payment, allowing you to keep your funds for continued savings building. This type of insurance also enables you to access the property sooner, allowing you to build equity more quickly.

With homeowners insurance, you’re protecting one of the most significant purchases you’ll ever make. If your home needs repairs or replacements, homeowners insurance may cover all or most of the costs, allowing your property to maintain its safety and value without putting a financial strain on your family. The economic security and protection against property damages, theft, vandalism, some natural disasters, and other perils will give you the peace of mind you need and deserve.

Outright Ownership

Homeowners insurance is still a requirement from many providers unless you own your home outright. You’ll have the right to decide whether to keep the policy or cancel it.

Without insurance, financial protection isn’t a guarantee. Therefore, in the event of unexpected situations, your home could suffer significant damages and losses that are challenging or impossible to repair and replace. Liability claims could also be filed against you if someone is hurt while on your property. To avoid these financial setbacks, you should maintain a homeowners insurance policy based on your needs, budget, and the property itself, even with outright ownership. For reliable, affordable homeowners insurance, San Diego homeowners know they can trust Altra Insurance Services. We also provide renters, commercial, motorcycle, and auto insurance. San Diego residents can receive a free quote by calling one of our friendly agents today.