Table of Content

As an employee or business owner, it’s important to know about the types of insurance coverage you might be eligible to purchase. Group commercial insurance is a type of coverage provided to members or employees of a company or organization. If you’ve ever had the opportunity to enroll in insurance coverage through your place of employment, you already have a good idea of what group commercial insurance involves. Diving a little deeper into how this coverage works helps you make the best decisions regarding how it could improve your financial security.

Understand How Group Commercial Insurance Works

Most people purchase individual forms of insurance for their cars and homes. You might also have individual policies for a small business endeavor. Group commercial insurance is designed for organizations and companies to purchase on behalf of their members or employees.

While you’ll notice this type of coverage is designed for a group, each person enrolled in the program is provided with an individual policy. As a business owner, it’s common to use group commercial insurance coverage as a perk to encourage the top talent to work for your company. Going above and beyond the traditionally expected levels of coverage entices employees to work for your company. As an employee, you’ll have the option of enrolling or declining the coverage. The amount each member of the group coverage pays can vary according to the terms of the policies.

Consider the Benefits of Using Group Commercial Insurance

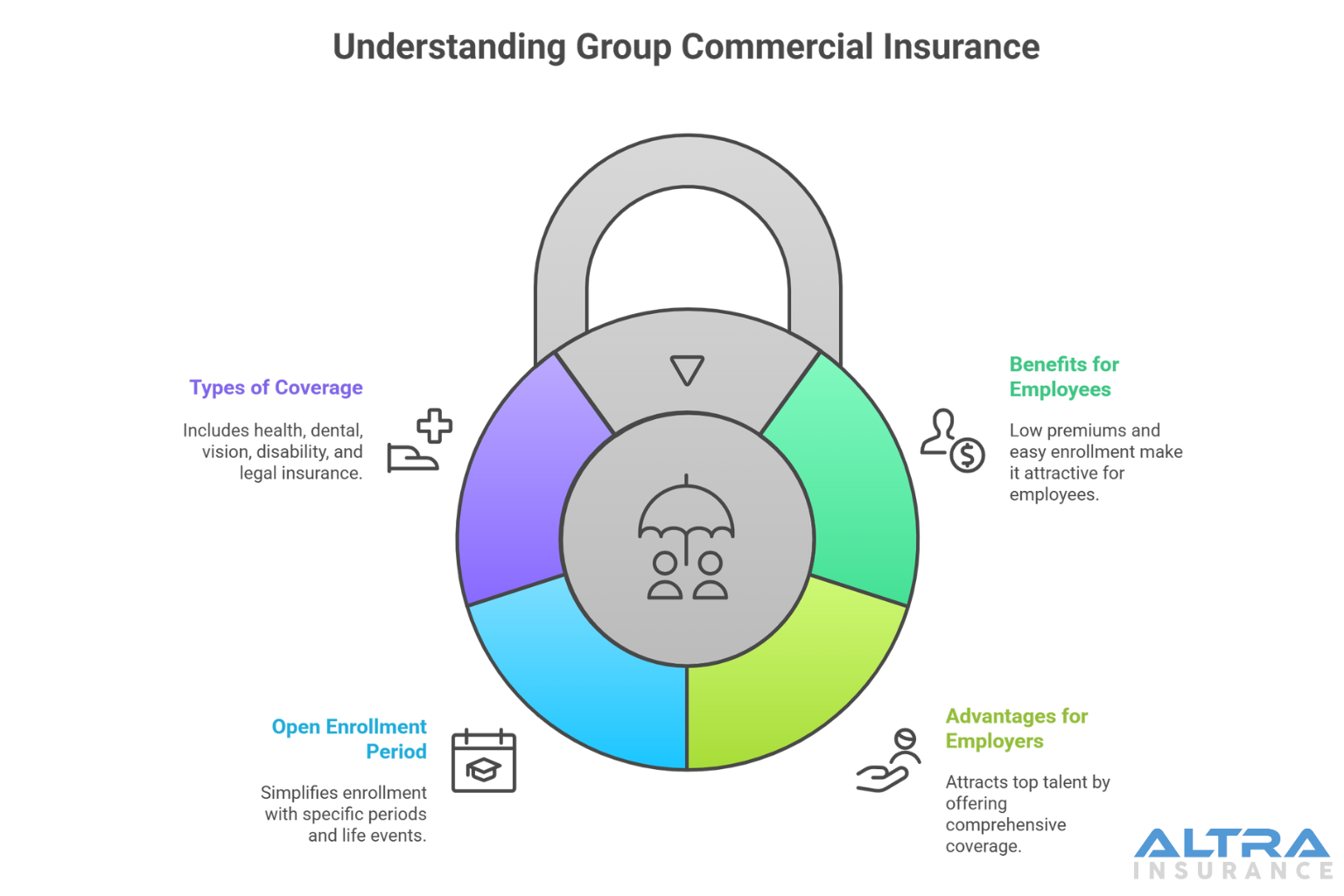

Since there’s a larger pool of people paying into the insurance programs, you’ll find individuals have low premiums that help them save money. You might also find that enrolling in the program is easier, since your employer already has a set pathway to purchase the policies. Although every policy is different, opting into a group coverage plan could also make it possible to opt out of having to participate in physical exams and other requirements you might have for an individual form of coverage.

Pay Attention to the Open Enrollment Period

To simplify coverage, insurance companies require people to use an open enrollment period to initiate their participation in group commercial insurance programs. In many cases, this enrollment period aligns with the one the ACA Health Insurance Marketplace uses. But you can also enroll in group insurance programs after specific events such as obtaining a new job or welcoming a new baby to your family.

Know about the Different Types of Group Commercial Insurance

Health coverage is the most common type of group commercial insurance people use on a regular basis. In fact, you might find yourself drawn to companies offering higher employer-paid premiums that allow you to make lower payments toward your policy. You’ll also likely have the ability to opt into other forms of group insurance that include dental, vision, disability, and legal coverage.

Choosing which elements to include in your benefits package can involve some careful decision-making. But it’s typically best to opt into the types of plans that best fit your needs for health care and other concerns. Since you never know what life might throw your way, knowing you have coverage under a group insurance plan helps you manage unexpected events with less stress.

Business owners need to make sure they protect their companies and employees by purchasing the right insurance coverage. For affordable, reliable commercial insurance as well as homeowners, renters, motorcycle, and auto insurance Chula Vista, call on the trustworthy professionals at Altra Insurance Services. Reach out to us today to learn how we can satisfy all your insurance needs.